us germany tax treaty interest income

Kimmitt and Barbara Hendricks Parliamentary Secretary of State Ministry of Finance signed a new Protocol to amend the existing bilateral income tax treaty concluded in 1989 between the two countries. WASHINGTON DC The Treasury Department today announced that Deputy Secretary Robert M.

Us Taxes Worldwide Income Escape Artist

The United States of America and the Federal Republic of Germany desiring to amend the Convention Between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes and the related Protocol signed at Bonn on.

. For example take the US income tax treaties with France Germany and Ireland interest royalties and dividends would he subject hold a maximum tax dependent of. It is based on model income tax treaties developed by the Department of the Treasury and the Organization for Economic Cooperation and Development. The United States has tax treaties with a number of foreign countries.

Agreement Between the United States of America and the Federal Republic of Germany to Improve International Tax Compliance and with respect to the United States. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. 1954 and amended by the protocol of September 17 1965.

Corporate Income Tax Rate. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Individual Capital Gains Tax Rate.

Our Freeman Law interactive tax treaty map provides a link to tax treaty materials for each US. Aa income from dividends within the meaning of. The purpose of the Germany-USA double taxation treaty.

277826 euros and more. Germany income tax law. The Protocol was signed Thursday in Berlin.

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in. This means that if you are a US NRA you would report the interest on your US tax return but then use the Foreign Tax Credit to reduce any taxes owed to zero. Germany - Tax Treaty Documents.

And I know that the tax treaty with Germany. In the US they are taxable as normal income when I make a withdrawal distribution. The income must also be reported on the US.

Corporate Capital Gains Tax Rate. First to avoid double taxation of income earned by a citizen or resident of one country in the other country. And second the treaty helps to promote residents of either country from avoiding taxes.

Beyond this unreimbursed business expenses can be deducted if they are itemized with receipts. Withholding tax on US-source dividends and related-party interest paid to residents of Russia. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Bank account by an American residing in Germany will be taxable in Germany under the USGerman tax treaty. Over 95 tax treaties. For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income.

For example interest earned on a US. US-source income generally includes among other. Under Article 11 of the US-Germany tax treaty the US is not allowed to impose any tax on US-sourced interest earned by a German resident.

Signed the OECD multilateral instrument MLI on July 7 2017. The treaty has two main goals. Germany and the United States of America for the Avoidance of Double Taxation and.

77 rows Interest paid to non-residents other than on convertible or profit-sharing bonds and. For instance all workers get a standard deduction of 1000 euros. Return and a foreign tax credit can then be claimed.

Taxes on certain items of income they receive from sources within the United States. The United States is a signatory to more than 60 income tax treaties. Evasion with Respect to Taxes on Income and Capital and to Certain Other Taxes signed at Bonn on August 29 1989 as amended by the Protocol signed at Berlin on June 1 2006.

As in the US you can reduce your overall tax liability in Germany by making use of deductions. US income tax law. Article 11-----Interest Article 12-----Royalties.

Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US. 58597 - 277825 euros. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

Tax treaties often change the otherwise applicable income sourcing rules. B There shall be allowed as a credit against German tax on income subject to the provisions of German tax law regarding credit for foreign tax the United States tax paid in accordance with the law of the United States and with the provisions of this Convention on the following items of income. The German-American tax treaty has been in effect since 1990.

It is my understanding that the interest and dividends from this account are taxable in Germany in the year they occur even though they are not taxable in the US. Progressive rates from 14-45. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

United States Income Tax Treaties - A to Z. Summary of US tax treaty benefits. The complete texts of the following tax treaty documents are available in Adobe PDF format.

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Tax rates and presumptions of taxable income like in connection with the cough of payment plan Tax treaties may reduce and eliminate withholding of big tax. Most importantly for German investors in the United States the Protocol would eliminate the withholding.

Without treaty protection Russian investors in the United States would be subject to 30 of the US.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

What Is The U S Germany Income Tax Treaty Becker International Law

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

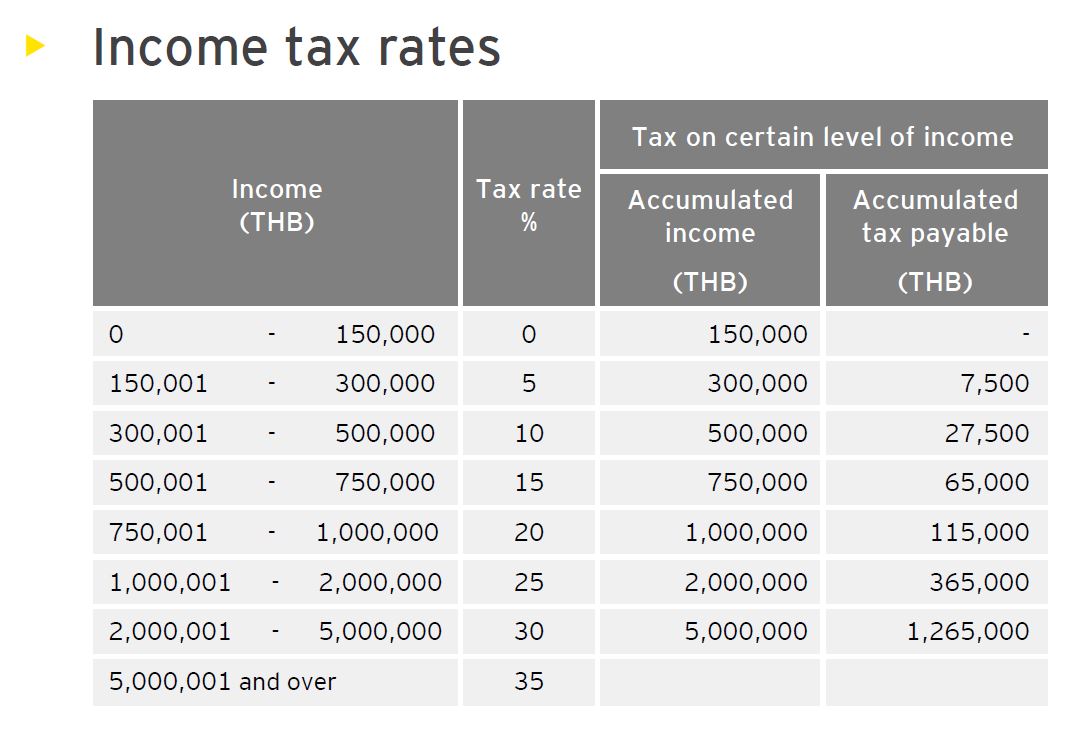

Real Estate Taxation In Thailand Thai Property Group

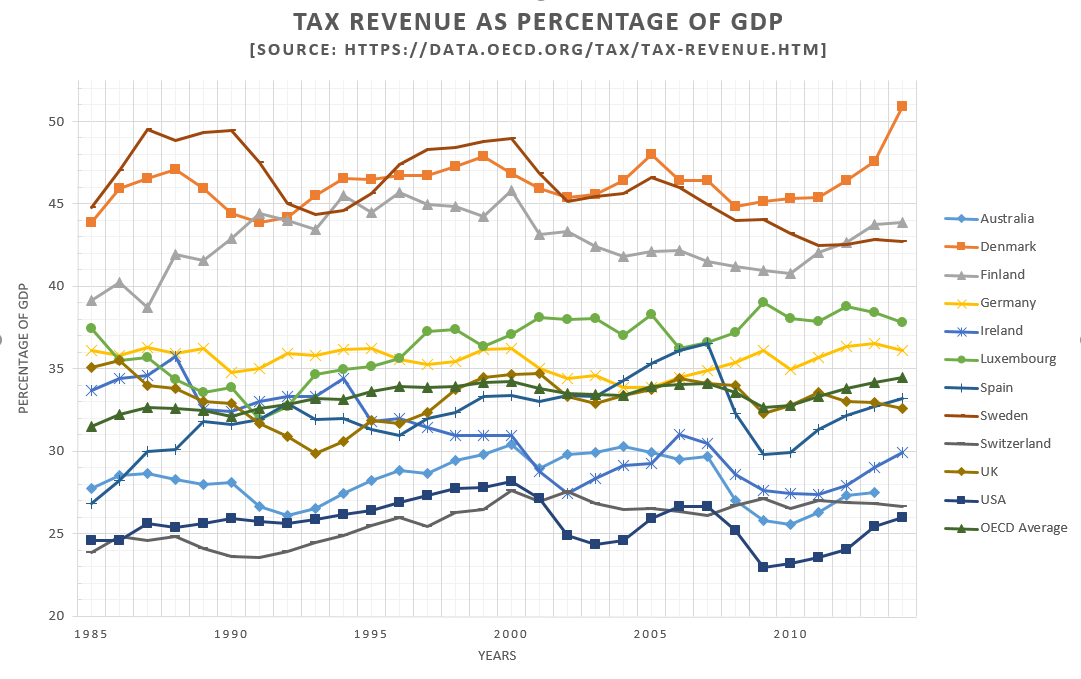

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

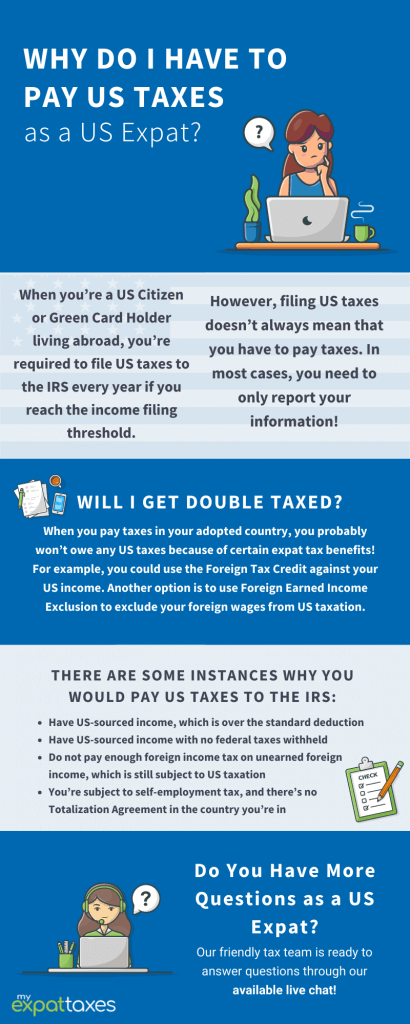

Paying Us Expat Taxes As An American Abroad Myexpattaxes

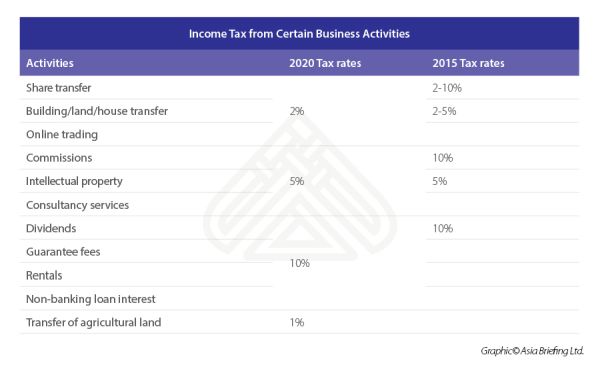

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

Doing Business In The United States Federal Tax Issues Pwc

United States Germany Income Tax Treaty Sf Tax Counsel

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding